How to Create a Financial Plan That Supports Your Dreams: From Debt to Investing

A financial plan is not about perfection or rigid control. It is a way to reduce uncertainty and make everyday decisions feel steadier. When your money has direction, it becomes easier to plan, rest, and think long term. Whether you are working through debt, building savings, or preparing to invest, a thoughtful plan creates structure without pressure.

Understanding Your Current Financial Picture

Before making changes, it helps to see where you are. This step is about clarity, not self-criticism. Write everything down so nothing stays vague or half-known.

Take note of:

All sources of income, including irregular or seasonal earnings

Monthly expenses, both fixed and flexible

Outstanding debts with balances and interest rates

Existing savings, even if they feel small

Once everything is visible, patterns often emerge. You may notice areas where money quietly leaks away, or places where spending feels aligned and supportive. This awareness becomes your reference point for future decisions.

Clarifying What You Want Your Money to Support

Goals feel more sustainable when they connect to your life rather than abstract numbers. Instead of focusing only on amounts, consider what each goal represents.

Your goals might include:

Reducing financial stress by paying off high-interest debt

Creating stability through savings

Preparing for a life change, such as a move or career shift

Building long-term security through investing

Place each goal on a realistic timeline and focus on progress rather than speed. Smaller milestones make long-term plans feel less overwhelming and easier to maintain.

Building a Budget That Reflects Your Priorities

A budget is simply a plan for how your income supports your life. Start with essentials such as housing, utilities, food, and transportation. Then decide how much can be directed toward debt repayment and savings.

A supportive budget often includes:

Clear limits that prevent overspending without feeling restrictive

Room for rest, enjoyment, and flexibility

Simple categories that are easy to track and adjust

When a budget reflects your priorities, it feels like guidance rather than control. If something feels unsustainable, adjust it. A plan that works over time matters more than a strict plan that creates tension.

Reducing Debt with Intention

Debt can create ongoing mental and emotional weight, which is why having a clear approach matters. Begin by listing each debt along with its balance, interest rate, and minimum payment.

Two common repayment approaches include:

Focusing on higher interest debts first to reduce overall cost

Paying smaller balances first to build confidence and momentum

Choose the approach that feels manageable for you. As balances decrease, the money once used for payments can support savings and future goals.

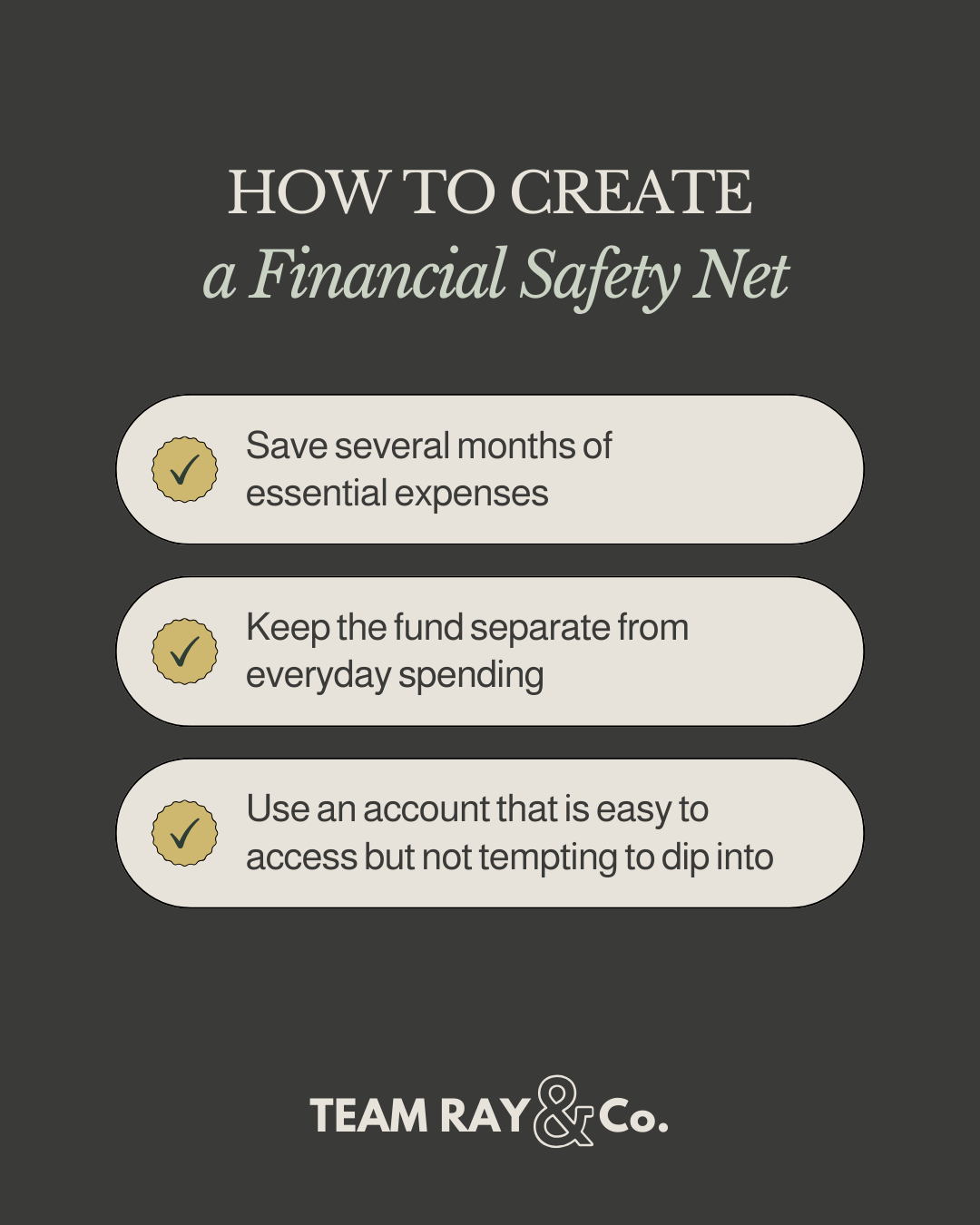

How to Create a Financial Safety Net

An emergency fund offers steadiness during unexpected moments. It helps cover expenses such as medical bills, repairs, or temporary income changes without relying on credit.

Aim to:

Save several months of essential expenses

Keep the fund separate from everyday spending

Use an account that is easy to access but not tempting to dip into

This cushion creates breathing room and makes long-term planning feel safer.

Saving and Investing for the Future

Once debt feels more manageable and savings are in place, investing becomes a way to support future needs. The focus here is consistency rather than complexity.

Common paths include:

Retirement accounts that offer tax advantages

Diversified funds that spread risk across assets

A mix of investments suited to your time horizon and comfort level

If uncertainty arises, working with a qualified financial professional can help clarify options and reduce guesswork.

Revisiting and Adjusting Over Time

A financial plan is not static. It shifts as your life changes. Regular check-ins help ensure your plan still fits your needs.

During reviews, consider:

Changes in income or expenses

Shifts in priorities or goals

Progress toward debt reduction and savings

Small adjustments made early are often easier than large corrections later.

A financial plan is a quiet form of support. It reduces decision fatigue and replaces uncertainty with direction. Over time, clarity builds confidence, and small choices begin to feel purposeful rather than reactive. Each step you take strengthens your ability to support the life you are building, both now and in the future.

If you want, I can also tailor this for a specific audience or align it more closely with your home, lifestyle, and seasonal living series so it feels fully integrated.